Tax treatment of interest expense 1 - 3 6. Export Procedures on The Import DutyTax Exempted Raw Materials and Packaging Materials.

Last Updated.

. INLAND REVENUE BOARD OF MALAYSIA Date Of DEFERRED ANNUITY Public Ruling No. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

Effective Date 25 DIRECTOR GENERALS PUBLIC RULING A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is. INLAND REVENUE BOARD MALAYSIA Public Ruling No. 24 June 2014 Page 1 of 19 1.

15 April 2013 Page 2 of 34 214. 12006 dated 25 February 2009 and c Third Addendum to Public Ruling No12006 dated 30 July 2009. Tax treatment for investment holding company listed 15 - 25 on the Bursa Malaysia 10.

DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. On the Bursa Malaysia 9.

The Director General may withdraw this Public Ruling either wholly or in part by notice of. The Director General may withdraw this Public Ruling either wholly or in part by notice of. 7 February 2011 CONTENTS Page 1.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. 012018 - Supply of Commercial Residential Premise. A limited company may be public or private limited by shares or guarantee and formed.

1 Business and Tax Information. Interest restriction under subsection 332 of the ITA 3 - 7 7. PSI is a professional body recognized by the Malaysian Pharmaceutical Board MPB under the.

INLAND REVENUE BOARD OF MALAYSIA PROFESSIONAL Public Ruling No. 12019 Date of Publication. Fire Natural Disaster and Losses.

022017 - Supply by Healthcare Professional. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. Objective The objective of this Public Ruling PR is to explain - 11 the deductibility of premiums paid by an individual for deferred annuity.

Income Tax Accelerated Capital Allowance Security Control Equipment and Monitor Equipment Rule s 2013 PUA 4. 273 Income Tax Rulings 113 274 Stamp Duty 113 275 Labuan International Business Financial Centre 120. 52019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

Capital allowance Industrial building allowance 25 11. 19 November 2019 DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. 12 the exemption of annuity income for an individual.

DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. Waste Scrap and Damaged Raw Materials and Finished Goods. A Public Ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board.

Gains or profits in lieu of interest 1 3. It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied. 22011 Date of Issue.

042017 - Issuance and Holding of Securities. 122018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Approval Process of Value-Added Activity and The Expansion Scope of Additional Activities.

Interpretation The words used in this Ruling have the following meaning. A Public Ruling may be withdrawn either wholly or in part. 19 December 2018 DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General of Inland Revenue is empowered to make a Public Ruling in relation to the application of any provisions of the ITA.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. MALAYSIA Established in 1978 Baker Tilly is the 7th largest accounting and business advisory firm in Malaysia. INLAND REVENUE BOARD OF MALAYSIA Date Of Issue ACCELERATE CAPITAL ALLOWANCE Public Ruling No.

012017 - Imposition of Penalty. 032017 - Gift Rule. This Ruling is published to merge Public Ruling No12006 issued on 17 January 2006 with a Addendum to Public Ruling No12006 dated 30 August 2007 b Second Addendum to Public Ruling No.

DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. It sets out the interpretation of the Director General in respect of the particular tax law and the policy as well as the procedure applicable to it.

It sets out the interpretation of the Director General in respect of the particular tax law and the policy as well as the procedure applicable to it. 18 February 2019 Page 2 of 9 Example 1 Matthew is a pharmacist registered with a professional body in Ireland the Pharmaceutical Society of Ireland PSI. Related provisions 1 4.

Malaysian Government Plans To Wrest Control Of Renong Wsj

Malaysia S Political Polarization Race Religion And Reform Political Polarization In South And Southeast Asia Old Divisions New Dangers Carnegie Endowment For International Peace

St Partners Plt Chartered Accountants Malaysia Photos Facebook

Political Financing Reform Politics Policies And Patronage In Malaysia Journal Of Contemporary Asia Vol 50 No 1

Follow Love Is Not Tourism Malaysia S Lovenotourismmy Latest Tweets Twitter

Payments That Are Subject To Withholding Tax Wt

Malaysia S New Minimum Wage To Take Effect From 1 May 2022 What Employers Should Note

Over 7 3 Million Tweets For Ge14 In Malaysia

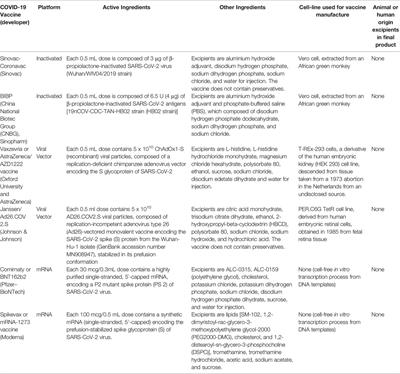

Frontiers Sharia Islamic Law Perspectives Of Covid 19 Vaccines

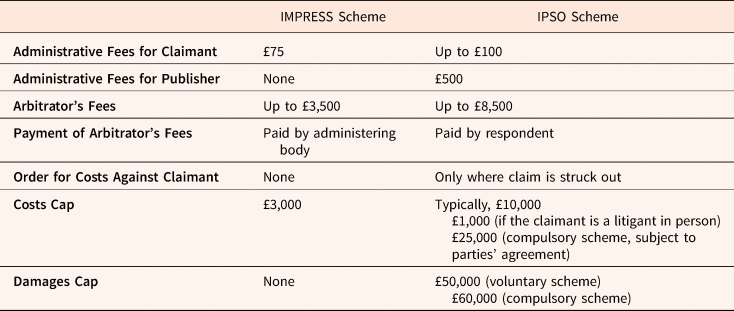

Media Arbitration Schemes Addressing The Backlog Of Defamation Cases In Malaysia Asian Journal Of Comparative Law Cambridge Core